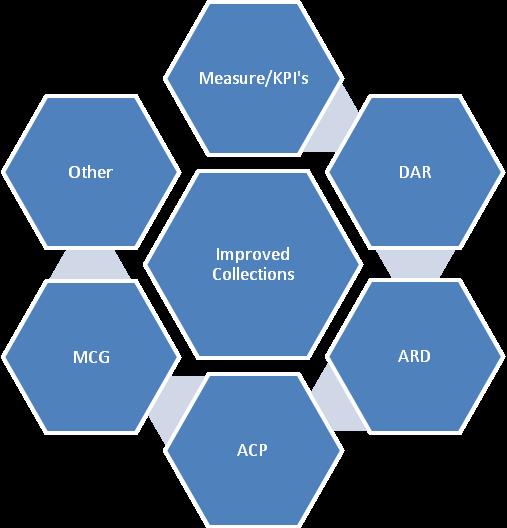

Ask yourself, “Are my collections being maximized?” Whether you said “yes” or “no”, ask yourself, “How do I know my collections are being maximized?” If you are not incorporating Key Performance Indicators (KPIs) into your practice, you may not know the true answer to either of these questions. Too often we hear that the provider is making enough money to support his needs. But too often the provider is working too hard for the money being collected.

Ask yourself, “Are my collections being maximized?” Whether you said “yes” or “no”, ask yourself, “How do I know my collections are being maximized?” If you are not incorporating Key Performance Indicators (KPIs) into your practice, you may not know the true answer to either of these questions. Too often we hear that the provider is making enough money to support his needs. But too often the provider is working too hard for the money being collected.

What are Key Performance Indicators? KPIs are performance measurements that measure the success of your practice. They will help you determine if you are working too hard or if your staff or billing company are not working hard enough.

Days in Accounts Receivable (DAR) – This is one of the most important KPIs to review on a monthly basis. We recommend that when you review your total charges and collections at the end of the month, you also make sure that your Days in Accounts Receivable is looked at carefully as well. This KPI helps you understand how long it takes to collect on charges. Typically this KPI is calculated by dividing your current Accounts Receivable by the average charges for the previous three months times 30 days. For example:

June charges - $100,000

July charges - $125,000

August charges - $95,000

Ending Accounts Receivable - $110,000

DAR = [110,000/((100,000 + 125,000 + 95,000)/3)] X 30 days = 31 days

It is important to note, though, that your payor mix will drive your DAR. A provider with high Medicare and low Auto and Work Comp will have a much lower DAR than a provider with the opposite mix. When determining what a good DAR would be, you need to consider your mix. Some medical societies can also provide you with an average DAR for your specialty. If your DAR exceeds the recommended days, a prompt audit of your billing processes should be performed.

Accounts Receivable Distribution (ARD) – This KPI should also be reviewed on a monthly basis. In order to calculate your ARD, you would divide the outstanding balance in each of the 30, 60, 90, 120 days columns of your AR report by the total outstanding accounts receivable.

| Total | 30 Days | 60 Days | 90 Days | 120 Days |

| $110,000 | $95,000 | $10,000 | $2,500 | $2,500 |

| 100% | 86.4% | 9% | 2.3% | 2.3% |

It is important that you monitor this KPI to make sure that you do not have claims that are not being worked. This KPI can also be affected by your payer mix. Medicare and most commercial payors should pay in 14 to 21 days. Therefore, if you do not have mostly auto or work comp, you should see the highest percentage under 30 days. For instance, a primary care seeing mostly patients with Medicare or commercial plans, should easily have 90 to 95% in the under 30-day column. If your over 90-day column or over 120-day column is higher than the under 30-day column or the under 60-day column, again, you should promptly audit your billing processes. You may find that it is a billing issue, but it could also be a sign of a credentialing or even a payor issue.

Average Collection Percentage (ACP) – Understanding this KPI is very important. Most providers will ask their peers about their Average Collection Percentage to benchmark if they are in line with where they should be. But, unless each provider has exactly the same fee schedule, with the exact payor allowables, and the exact payor mix, these two providers are comparing apples to oranges. Although the Average Collection Percentage is more complex than the above calculations, it is not impossible.

To determine your Average Collection Percentage, you would need to calculate your average collection percentage by payor then weight it based on your specific payor mix. The following would be an example of calculating your ACP:

| Payor | Allowable % of Charge |

Payor Mix | Average Collection % |

| Medicare | 60% | 50% | 30% |

| Florida Blue | 70% | 35% | 24.5% |

| Commercials | 65% | 10% | 6.5% |

| Auto & Work Comp | 70% | 5% | 3.5% |

| Average Collection Percentage | 64.5% |

This KPI will help indicate when you have an overall problem with your collections. It should remain steady from month to month, but if there is a drastic change in your Average Collection Percentage, it would need to be reviewed immediately. An example of this would be if you had a large shift in your payor mix, this could cause a change from a steady percentage.

Monthly Collection Goal (MCG) – This KPI should be reviewed on a daily basis. At the beginning of each month, you should set your Monthly Collection Goal by multiplying the average charges over the last three months by your Average Collection Percentage from above.

MCG = [(100,000 + 125,000 + 95,000)/3] X 64.5% = $68,800

Once you have determined your monthly goal, it can be monitored daily to determine if the collections will fall short for the month or meet the goal. If there is any indication that the goal is going to fall short, it is important to determine the reason.

We understand that as a provider, your most important goal is to provide the best possible services to your patients. However, utilizing the above Key Performance Indicators will help you maximize your collections and allow you to work smarter not harder.